Living in a condo or townhome community with a high concentration of households on a small piece of land can present a unique set of factors. It’s important to be aware of these and consider them before making a decision to live in this type of community.

One of the main factors to consider is privacy. When homes are built close together, and with shared walls this can compromise privacy, as sound can easily travel between neighboring households. Additionally, if it’s a new development there is likely no mature trees or privacy landscaping, further reducing privacy between properties. Older condo or townhome developments often have mature landscaping, which contributes to increased privacy and noise control.

Another factor is noise. With shared walls and shared outdoor spaces, noise can easily transfer from one home to another. Typical wood frame construction, commonly used in these communities, tends to amplify noise, making it even more of a potential concern.

Odors can also be an issue in close-knit communities. Each household has its own unique habits and preferences, which can lead to different types of odors, such as cooking smells, pet waste, smoke and more. If there are no rules or regulations in place to address these issues, or if the ventilation or construction methods are subpar, odors can easily transfer between units.

To mitigate these issues, it’s crucial to ensure that the community has clear Covenants, Conditions, and Restrictions (CC&Rs) or Rules and Regulations that all residents must adhere to. While rules may not be everyone’s favorite thing, they are essential in ensuring that neighbors are considerate and respectful of one another in these close proximity living situations.

Equally important is an active Homeowners Association (HOA) that enforces these rules. Without proper enforcement, rules become meaningless. An HOA provides a valuable resource for addressing any concerns or issues that may arise, sparing you from potentially uncomfortable confrontations with neighbors.

When considering a community, it’s also worth looking into the history and effectiveness of the HOA. The track record of the HOA in maintaining the community and enforcing the CC&Rs can give you a sense of their commitment to preserving the value and enjoyment of the property for all residents.

Mediterranean Villas: In comparison to other condos or townhomes, Mediterranean Villas stands out for its superior construction. These townhomes are built with Insulated Concrete Form (ICF) construction, which means the exterior walls and walls between homes are made of concrete instead of typical wood framing. This construction method significantly reduces noise transfer, odor transfer, and enhances energy efficiency. As a result, lower power bills can be expected compared to a typical wood-framed home.

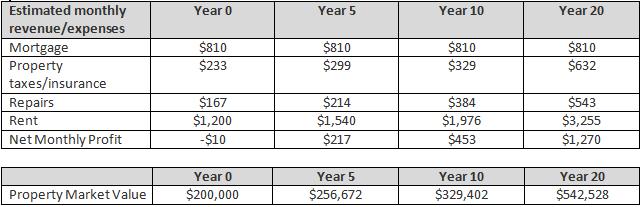

Mediterranean Villas was established in 2001 and consists of 224 townhomes. It has a reputation for being an all around great investment, and has always been a sought after subdivision. This too sets it apart from new construction offerings.

While older townhouses may have outdated finishes and systems, these can be easily replaced when necessary. The absence of CC&Rs, an inactive HOA, or a lack of a track record in a community are factors beyond your control. It’s important to consider these aspects and choose a community that aligns with your preferences both now and with the future in mind.