Tag Archives: housing

Don’t Let Downsizing Get You Down!

Downsizing can be emotionally and physically wearing. But it can also be a great excuse to de-clutter some of the things that you may have been holding onto for years. As Accredited Buyer’s Representatives (ABR®) working in Richland, Pasco, Kennewick and the surrounding Tri-Cities Washington area, we can help you find your next home and guide you in the steps needed to prepare yourself for the transition of moving into a (possibly) smaller space. The link below should answer some of your initial questions but for more detail and to learn about our specialized services and downsizing experience, give us a call. Jessica Johnson 509-947-2230 or Jennifer Cowgill 509-947-5670. We look forward to working with you!

Why You Should Work with a Full Time Real Estate Agent

With the advent of the internet and different broker and brokerage business models, there are a number of ways you can buy or sell a home in Tri-Cities these days. The key is to find a solution that works best for you and for the level of service you want and need.

Full service agents are generally those who work full-time in real estate, are connected with other agents and real estate professionals in the Richland, Kennewick and Pasco market, and we are professionals with a full set of buying and selling systems. Operating a real estate company is expensive and many of those full service agents do charge full commission to compensate for those expenses and to earn a living wage.

That is not to say you can’t get full service from a discount brokerage. However, you need to do your due diligence to make sure that what you want is what you will receive. With that in mind, below are some of the key elements we bring to the table as full service real estate professionals:

We have 25 years of combined experience with HUNDREDS of transactions under our belt – If you are a typical buyer or seller, you may participate in around five real estate transactions in your entire lifetime. Usually there are several years between those transactions. A lot can happen in the meantime. Just think about what that last several years has seen in terms of credit availability, market changes, law and process changes and even forms. However, a full-time real estate professional will tackle dozens of real estate transactions a year. Furthermore, since no two transactions are the same, a full-time real estate professional will be subjected to a number of different buyer and seller scenarios and needs to learn about each. Everything from Homeowner Association special assessments, view rights, easement issues, liens, and more – each provides a special learning opportunity for the full-time broker.

We have extensive process knowledge – Buying or selling a home is likely one of the most complex transactions of your life – one which requires lengthy contracts, multiple forms, disclosure statements, inspections, mortgage documents, title reports, insurance, deeds, and multiple professionals are needed to implement their part of the transaction seamlessly. Most people don’t have the knowledge to handle all their tax forms each year and rely either on an accountant or a step-by-step software program to make it through. There is no step-by-step software program for buying or selling a home due to all the complexities, local rules, and changes that must be adhered.

We are very familiar with local property professionals –a typical transaction can be touched by a number of different professionals:

- Listing broker

- Listing managing broker

- Selling broker

- Lender

- Underwriter

- Appraiser

- Inspector

- Title rep

- Title examiner

- Homeowner association

- Local utilities

- Escrow agent

- County recording office

Understanding the role of each one, what will be needed from them and what you need to get into their hands and when is something that brokers who complete dozens of transactions per year understand. This knowledge is critical for making sure the transaction is completed as planned and on schedule.

We get the lingo – Do you know what a CMA is? Do you need a POA if you are going out of town? Should you be concerned if you are buying a home where the HOA is MIA? We would be! A full-time real estate professional who has been around the block understands this lingo and will interpret it for you.

We are the voice of reason – There have been many times when a buyer we have been working with falls in love with a home riddled with problems or substandard building materials or times when a seller wants to list their home for a price that will be detrimental to their listing. A broker who is strong and has research and market knowledge on their side will speak up. We research market trends each and every week, and can advise a seller when their asking price is too high (or low!) and what adjustments we should make. We can advise a buyer on what to ask for in an inspection response based on current demand and current market trends with the goal of keeping the transaction together while also looking out for our buyers’ best interests. Without being in the trenches every day, we wouldn’t have that understanding and our advice might not be as timely as it could be.

We have savvy negotiation skills – Because we know the current market trends and have our finger on the pulse of supply and demand, we are equipped to negotiate powerfully for our clients. There are many negotiating factors including, but not limited to price, financing, terms, date of possession, and inclusion or exclusion of repairs, furnishings, and even who cleans the house. We love to negotiate and find the win-win solutions that bring the deal together with both parties.

Ongoing training and education is important to us – Although each state dictates the educational licensing requirements of any licensed broker or agent in the state, a full-time real estate professional takes this a step further, participating in real estate association-sponsored education and/or coaching. We make a commitment to stay up-to-date on any legal, form, and market changes so we always have the newest information. Our designations include, Accredited Buyers Agent (ABR), Senior Real Estate Specialist (SRES), Certified New Home Sales Professional (CSP) and Certified Aging in Place Specialist (CAPS).

What Buyers Need to Know

We have local knowledge on so many levels. As real estate agents there is a lot we keep track of on a local level – zoning and development, information on rental rules, water and sewer changes, rules regarding wells and septic systems, schools and district lines, challenges with faulty building products and geological issues, and transportation issues and changes. Not staying up-to-date on this local information would be akin to a doctor not keeping up with the American Medical Association Journal! As your real estate broker, we need to be prepared to provide information on what you might expect from your property in terms of your long-term quality of life and resale value. We need all the tools available to us to provide you with the information to make an informed decision.

We have the tools and relationships to help you find the best property for your needs. Did you know that sometimes the property that best meets your needs is not on the market at all? Homes that had cancelled or expired may not be currently listed on the MLS but they might be viable candidates for your needs. If the right home isn’t on the market, we use our resources to dig deeper. That may be connecting with an agent who has a listing coming on the market that might be a good fit, taking the time to contact homeowners whose homes may have been on the market some time ago, or utilizing the services of a title company to get addresses to send letters to, indicating that we have an active buyer who is looking in their area, for their type of home. Sometimes it takes work and time to find the right place to call home and you need a full-time real estate professional utilizing their resources to find it.

We know the professionals to call. When you have an inspection, the inspector’s job is to locate potential problems with the home. But then what? Should you investigate the problem further with a specialist? Call in a structural engineer or a pest inspector? We have helped our clients buy and sell homes of many a vintage in many a neighborhood. We always advise that buyers do their due diligence and have a variety of professionals on call to meet your needs with the quick turnaround these situations usually warrant.

We know how to write an offer that will get noticed. Believe it or not, it is not always about the price that is offered. We build a relationship with the listing agent to learn what is important to the seller, and armed with that information, we can construct an offer that takes both sets of needs into account which is more likely to result in success for my buyers. You need an agent who has a large bag of tricks – something that a full-time real estate professional can deliver.

What Sellers Need to Know

We help you price your home at market. We cannot tell you how critical this is for selling your home. Although some may prefer to simply use a popular property website to determine the price, according to the National Association of REALTORS®, those estimates can be up to 35% off. This could result in a seller thinking their home is worth $500,000, but it should really be priced closer to $325,000 in order to get attention from buyers. Every day we review the available inventory of homes, what has just come on the market and what has gone under contract to get a feel for the ever-fluctuating supply and demand. If supply starts to exceed demand, sellers need to be ready to make an adjustment to meet the market. If demand is high, then let’s use that to our advantage and employ a different strategy. But an online website won’t give you that advice based on current demand. A website isn’t going to be able to evaluate your view against your neighbor’s home that might have sold last week or how the hardwood floors in your home compare to the hardwood floors in a home a half mile away that sold six months ago. But we can because we know the inventory. We have the tools. And we use them all to meet your goals and get your home sold.

We employ listing syndication on dozens of websites to get your home noticed. We don’t just rely on the MLS to get your home in front of the largest potential buyer pool. We provide our sellers that extra visibility by way of listing syndication – having your property and photographs broadcast out to dozens of different property search sites. This way we can be sure that if a potential buyer is searching in Kalamazoo or Kentucky, your home will appear on their search results. You never know where the buyer for your home will come from!

Whether you are buying a home for the first time or selling your home to relocate or right-size, trust your most valuable asset to a full-time professional chock-full of expertise. We wouldn’t buy or sell a home with anyone but an expert and neither should you.

Call us anytime; we love to discuss Tri-Cities Real Estate Market!

Jessica Johnson, 509.947.2230 Jennifer Cowgill 509.947.5670

Summer Air Conditioning Maintenance

If you are planning on putting your home on the market, or have purchased a home in the last year, you may want to consider getting your air conditioning unit serviced now rather than waiting.

As the calendar moves from spring to summer, the air conditioner, whether you have a heat pump, swamp cooler, or some other type of cooling unit, will be in-demand in the coming months. So why act preventively? There are two important reasons:

- As a seller, it pays to have your air conditioning unit running smoothly while the house is on the market. With our typical heat spells here in the Tri-Cities where temperatures reach over 100 degrees you will be thankful you were proactive. If something happens to your unit while your home is listed, a non-air-conditioned home will definitely turn off potential buyers. If something happens on a weekend or in the evening, the service call to get repairs done quickly might cost you hundreds of dollars. Preventative service may help avoid this. Remember, servicing the unit may be something the buyer asks for at the inspection anyway, so this may already be an expense you would incur.

- As a new homeowner, it is a fact that you are likely to live differently in your house than the previous owner. Say you keep the home at a cool, crisp 68 degrees but the previous owner enjoyed the home at 75 degrees. Appliances, trying to accommodate this kind of change, can have system issues. If you think you are in the clear having bought a brand new home, think again. Just because a system is new does not mean it is free from any manufactures or other defects. If you sense the system is not operating optimally or cooling effectively call your contractor right away. Any good home builder will have contracted with a reputable HVAC company that uses good quality equipment and will warrant the product for a set amount of time.

As always call Jennifer Cowgill at 509-947-5670 or myself, Jessica Johnson at 509-947-2230 for any real estate buying, selling or building needs in Richland, Pasco, Kennewick and the surrounding areas!

Now go enjoy the Summer we are known for here in sunny Tri-Cities Washington!

HOME BUYING OPTIONS

If you are nervous about not being able to afford your first home, there may be a couple great options out there to help you secure a purchase. We found an article that highlights some of the government grants and programs that are out there to help first time home buyers. Take a look at this article and let us know if you have any additional questions. As Accredited Buyer’s Representative’s (ABR®), we are always looking for ways to make sure our buyers get exactly what they want.

Jessica Johnson 509-947-2230 / Jennifer Cowgill 509-947-5670

FOR BUYERS: OVERVIEW ON LOANS AND LOAN OFFICERS

Link

I found a great article on understanding the loan process of home buying. Find out what the role of a loan officer is, how to find one, and what questions to ask them. As an Accredited Buyer’s Representative (ABR®) at Referred Real Estate, our goal is to make sure you are prepared for the home buying process. Please let us know if you have additional questions. Call myself, Jessica at 509-947-2230 or Jennifer at 509-947-5670.

Tri-Cities Real Estate Market Update, December

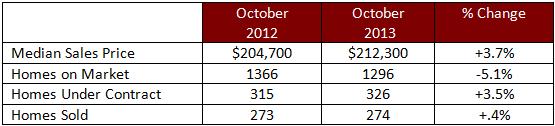

The end-of-2013 Tri-Cities real estate market information has just been released. Comparing December 2012 with December 2013 note that although median sales price decreased just a bit, the number of homes under contract and sold have seen significant gains.

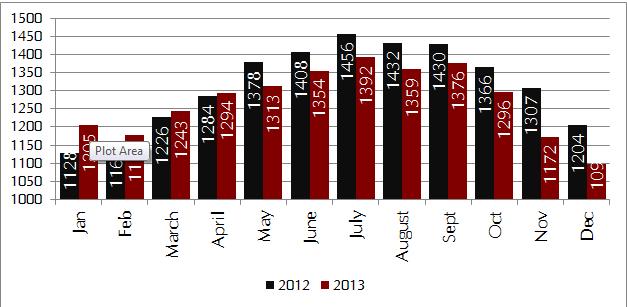

The numbers as a whole represent a year of modest growth. Below is the number of homes available on the market for both 2012 and 2013. As you can see, in April 2013, the number of homes available in the Tri-Cities began to decline. A smaller supply of homes with steady demand will cause home prices to increase, in this case modestly.

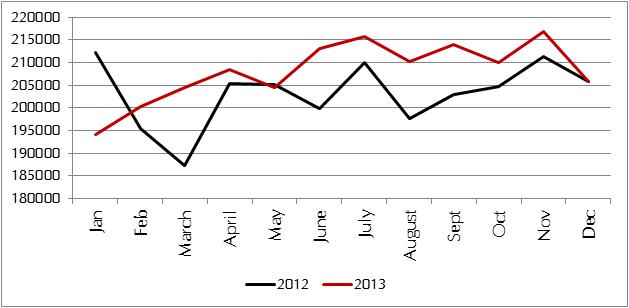

The below graph represents median home prices in the Tri-Cities over 2012 and 2013. Note that the 2013 line is almost consistently over the 2012 line, representing a small increase over 2012.

If you are interested in hearing more about our market, please give us a call: Jessica at (509) 947-2230 or Jennifer at (509) 947-5670.

Planning for Real Estate Tax Deductions

This time of year, people are thinking about their new year’s resolutions and beginning to get their taxes together for the April deadline. If you are renting or thinking about buying in the near future, there are many tax deductions that benefit homeowners that sometimes people don’t think about when weighing the benefits of renting versus owning:

Mortgage Interest Deduction – The interest homeowners pay to their lenders each year is deductible on mortgages up to $1 million. During the first several years of a loan, mortgage payments are interest-heavy which means the tax deductions for young mortgages can be substantial.

For example, for a median sales-priced home in the Tri-Cities ($212,300 as of October, 2013), the first 12 months of interest on a 4.6% loan can add up to $9,695. That interest can be immediately deducted from a taxpayer’s adjusted gross income, saving hundreds in tax liability for the first year alone.

Property Taxes – In states that have property taxes (including Washington State), those can also generally be deducted from the homeowners’ adjusted gross income. It is important to only include property taxes paid to the municipality – not to the lender as part of the escrow account.

Interest & Property Taxes on Second Homes – In many cases (depending on tax brackets and other IRS rules), the above two deductions can also apply to second properties. There are parameters to me met (such as the homeowner must stay at the home at least 14 days per year and it is not considered a rental property).

Home Equity Line of Credit Interest Tax Deduction – In the event a loan was secured against a home’s equity and the funds were used on “capital improvements” to a home, this interest may also be tax deductible.

Points for obtaining a loan – Points are usually a certain percentage of the loan and are either paid up front or over the duration of the loan. However, points are usually tax deductible over the duration of the loan period or in the year paid depending on if the loan is on a purchase or a refinance.

These deductions are presented as generalities only and you should confirm all eligibility with your tax professional. There are additional tax deductions that may benefit you if thinking about a purchase. If you have questions, Jennifer Cowgill can be reached at (509) 947-5670 or jennifer@referredrealestate.com or Jessica Johnson at (509) 947-2230 or jessica@referredrealestate.com.

* Above figures are based on 2012 tax table supplied by the IRS

Source:

Tri-Cities Real Estate Market Update, October

The September and October Tri-Cities real estate market information is hot off the presses! This has been another two months of modest growth over the previous year.

The below chart shows the data comparing September of 2012 and September of 2013.

The October data is also newly-available:

According to the National Association of REALTORS®, the Kennewick-Richland-Pasco metro area is seeing a upward trend in new home construction with 1,661 current building permits through June 2013. This is 36.7% above the long-term average of 1,215 permits.

Did you know that the Tri-Cities is only behind Seattle and Portland for the number of building permits in Washington and Oregon? In August, 2013, Seattle issued 6300 permits, Portland issued 3970 permits and Kennewick-Richland-Pasco issued 1000 permits. New construction is strong in our area.

If you are interested in hearing more about our market, please give us a call: Jessica at (509) 947-2230 or Jennifer at (509) 947-5670.

Sources

Real Estate Investing: The Power of Leverage

One question we get a lot is “how do I begin investing in real estate? Whether someone is considering a second home, a property to improve and sell, or a property to rent and hold, investors starting out need to understand the power of leverage.

Leverage is the term used when one may not have the cash on hand to buy something outright, so they borrow someone else’s money (usually a bank’s) to finance their investment. Certainly the loan is paid back with interest, but the asset purchased appreciates at the full amount of the investment regardless of what was borrowed.

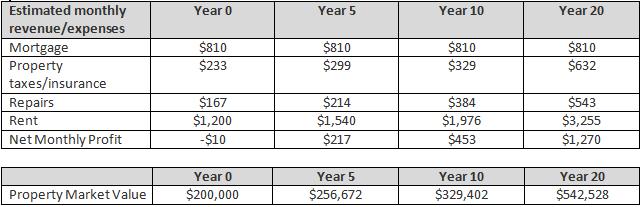

Let us give you an example. Let’s say a new real estate investor wants to purchase a second home in our area at $200,000. He has 20% to put down, or $40,000. He borrows $160,000 from the bank at 4.5% interest for a 30 year fixed rate loan and he plans to rent out the home for $1,200 per month.

His principle and interest payment is $810 per month. Of course, this does not include property taxes or insurance, which can be estimated at another $233 per month. Additionally, it is smart to estimate repairs at least 1% of the home value – in this case $2,000 per year.

At first glance, it doesn’t appear that the math works in this property owner’s favor as he is looking at a net loss in this case of $10 per month! And that is assuming that the property does not remain vacant, need major repairs, and he handles the rental himself instead of involving a property management company.

Here is where the value of appreciation and cost of living come into play. Unless our investor refinances, his payments for the next 30 years will be $810 per month. However, during that time a number of other forces are at work. Rents rise each year. At an approximate 5% increase per year in rent, that $1,200 in income today will equate to $1,540 in five years. We can assume that property taxes and insurance might rise at that same rate, leaving our investor in a slightly better position monthly than his $9 net loss of five years previous.

Let’s take a closer look at the 10 year figures listed above. At a modest 5% appreciation, the property purchased today would be worth $329,402 in 10 years. If our investor decided to sell and walk away from the $453 in net profits per month, he could be looking at gross proceeds of $201,259 (as his loan at this point has been reduced to $128,143). This doesn’t take into account closing costs, but isn’t it amazing how $40,000 can turn into over $200,000 in a relatively short amount of time?

Additionally, savvy investors need to realize there is another perk of owning multiple properties -interest deduction on taxes. The mortgage interest paid on your home loans is tax deductible depending on how your investments are set up. In the example above, $7,147 is paid in interest on the first year alone which could result in big tax savings!

If you are interested in learning more about how to leverage your next home purchase or real estate investments, please contact us: Jennifer at (509) 947-5670 or Jessica at (509) 947-2230.