Downsizing can be emotionally and physically wearing. But it can also be a great excuse to de-clutter some of the things that you may have been holding onto for years. As Accredited Buyer’s Representatives (ABR®) working in Richland, Pasco, Kennewick and the surrounding Tri-Cities Washington area, we can help you find your next home and guide you in the steps needed to prepare yourself for the transition of moving into a (possibly) smaller space. The link below should answer some of your initial questions but for more detail and to learn about our specialized services and downsizing experience, give us a call. Jessica Johnson 509-947-2230 or Jennifer Cowgill 509-947-5670. We look forward to working with you!

Tag Archives: selling property

Why You Should Work with a Full Time Real Estate Agent

With the advent of the internet and different broker and brokerage business models, there are a number of ways you can buy or sell a home in Tri-Cities these days. The key is to find a solution that works best for you and for the level of service you want and need.

Full service agents are generally those who work full-time in real estate, are connected with other agents and real estate professionals in the Richland, Kennewick and Pasco market, and we are professionals with a full set of buying and selling systems. Operating a real estate company is expensive and many of those full service agents do charge full commission to compensate for those expenses and to earn a living wage.

That is not to say you can’t get full service from a discount brokerage. However, you need to do your due diligence to make sure that what you want is what you will receive. With that in mind, below are some of the key elements we bring to the table as full service real estate professionals:

We have 25 years of combined experience with HUNDREDS of transactions under our belt – If you are a typical buyer or seller, you may participate in around five real estate transactions in your entire lifetime. Usually there are several years between those transactions. A lot can happen in the meantime. Just think about what that last several years has seen in terms of credit availability, market changes, law and process changes and even forms. However, a full-time real estate professional will tackle dozens of real estate transactions a year. Furthermore, since no two transactions are the same, a full-time real estate professional will be subjected to a number of different buyer and seller scenarios and needs to learn about each. Everything from Homeowner Association special assessments, view rights, easement issues, liens, and more – each provides a special learning opportunity for the full-time broker.

We have extensive process knowledge – Buying or selling a home is likely one of the most complex transactions of your life – one which requires lengthy contracts, multiple forms, disclosure statements, inspections, mortgage documents, title reports, insurance, deeds, and multiple professionals are needed to implement their part of the transaction seamlessly. Most people don’t have the knowledge to handle all their tax forms each year and rely either on an accountant or a step-by-step software program to make it through. There is no step-by-step software program for buying or selling a home due to all the complexities, local rules, and changes that must be adhered.

We are very familiar with local property professionals –a typical transaction can be touched by a number of different professionals:

- Listing broker

- Listing managing broker

- Selling broker

- Lender

- Underwriter

- Appraiser

- Inspector

- Title rep

- Title examiner

- Homeowner association

- Local utilities

- Escrow agent

- County recording office

Understanding the role of each one, what will be needed from them and what you need to get into their hands and when is something that brokers who complete dozens of transactions per year understand. This knowledge is critical for making sure the transaction is completed as planned and on schedule.

We get the lingo – Do you know what a CMA is? Do you need a POA if you are going out of town? Should you be concerned if you are buying a home where the HOA is MIA? We would be! A full-time real estate professional who has been around the block understands this lingo and will interpret it for you.

We are the voice of reason – There have been many times when a buyer we have been working with falls in love with a home riddled with problems or substandard building materials or times when a seller wants to list their home for a price that will be detrimental to their listing. A broker who is strong and has research and market knowledge on their side will speak up. We research market trends each and every week, and can advise a seller when their asking price is too high (or low!) and what adjustments we should make. We can advise a buyer on what to ask for in an inspection response based on current demand and current market trends with the goal of keeping the transaction together while also looking out for our buyers’ best interests. Without being in the trenches every day, we wouldn’t have that understanding and our advice might not be as timely as it could be.

We have savvy negotiation skills – Because we know the current market trends and have our finger on the pulse of supply and demand, we are equipped to negotiate powerfully for our clients. There are many negotiating factors including, but not limited to price, financing, terms, date of possession, and inclusion or exclusion of repairs, furnishings, and even who cleans the house. We love to negotiate and find the win-win solutions that bring the deal together with both parties.

Ongoing training and education is important to us – Although each state dictates the educational licensing requirements of any licensed broker or agent in the state, a full-time real estate professional takes this a step further, participating in real estate association-sponsored education and/or coaching. We make a commitment to stay up-to-date on any legal, form, and market changes so we always have the newest information. Our designations include, Accredited Buyers Agent (ABR), Senior Real Estate Specialist (SRES), Certified New Home Sales Professional (CSP) and Certified Aging in Place Specialist (CAPS).

What Buyers Need to Know

We have local knowledge on so many levels. As real estate agents there is a lot we keep track of on a local level – zoning and development, information on rental rules, water and sewer changes, rules regarding wells and septic systems, schools and district lines, challenges with faulty building products and geological issues, and transportation issues and changes. Not staying up-to-date on this local information would be akin to a doctor not keeping up with the American Medical Association Journal! As your real estate broker, we need to be prepared to provide information on what you might expect from your property in terms of your long-term quality of life and resale value. We need all the tools available to us to provide you with the information to make an informed decision.

We have the tools and relationships to help you find the best property for your needs. Did you know that sometimes the property that best meets your needs is not on the market at all? Homes that had cancelled or expired may not be currently listed on the MLS but they might be viable candidates for your needs. If the right home isn’t on the market, we use our resources to dig deeper. That may be connecting with an agent who has a listing coming on the market that might be a good fit, taking the time to contact homeowners whose homes may have been on the market some time ago, or utilizing the services of a title company to get addresses to send letters to, indicating that we have an active buyer who is looking in their area, for their type of home. Sometimes it takes work and time to find the right place to call home and you need a full-time real estate professional utilizing their resources to find it.

We know the professionals to call. When you have an inspection, the inspector’s job is to locate potential problems with the home. But then what? Should you investigate the problem further with a specialist? Call in a structural engineer or a pest inspector? We have helped our clients buy and sell homes of many a vintage in many a neighborhood. We always advise that buyers do their due diligence and have a variety of professionals on call to meet your needs with the quick turnaround these situations usually warrant.

We know how to write an offer that will get noticed. Believe it or not, it is not always about the price that is offered. We build a relationship with the listing agent to learn what is important to the seller, and armed with that information, we can construct an offer that takes both sets of needs into account which is more likely to result in success for my buyers. You need an agent who has a large bag of tricks – something that a full-time real estate professional can deliver.

What Sellers Need to Know

We help you price your home at market. We cannot tell you how critical this is for selling your home. Although some may prefer to simply use a popular property website to determine the price, according to the National Association of REALTORS®, those estimates can be up to 35% off. This could result in a seller thinking their home is worth $500,000, but it should really be priced closer to $325,000 in order to get attention from buyers. Every day we review the available inventory of homes, what has just come on the market and what has gone under contract to get a feel for the ever-fluctuating supply and demand. If supply starts to exceed demand, sellers need to be ready to make an adjustment to meet the market. If demand is high, then let’s use that to our advantage and employ a different strategy. But an online website won’t give you that advice based on current demand. A website isn’t going to be able to evaluate your view against your neighbor’s home that might have sold last week or how the hardwood floors in your home compare to the hardwood floors in a home a half mile away that sold six months ago. But we can because we know the inventory. We have the tools. And we use them all to meet your goals and get your home sold.

We employ listing syndication on dozens of websites to get your home noticed. We don’t just rely on the MLS to get your home in front of the largest potential buyer pool. We provide our sellers that extra visibility by way of listing syndication – having your property and photographs broadcast out to dozens of different property search sites. This way we can be sure that if a potential buyer is searching in Kalamazoo or Kentucky, your home will appear on their search results. You never know where the buyer for your home will come from!

Whether you are buying a home for the first time or selling your home to relocate or right-size, trust your most valuable asset to a full-time professional chock-full of expertise. We wouldn’t buy or sell a home with anyone but an expert and neither should you.

Call us anytime; we love to discuss Tri-Cities Real Estate Market!

Jessica Johnson, 509.947.2230 Jennifer Cowgill 509.947.5670

Summer Air Conditioning Maintenance

If you are planning on putting your home on the market, or have purchased a home in the last year, you may want to consider getting your air conditioning unit serviced now rather than waiting.

As the calendar moves from spring to summer, the air conditioner, whether you have a heat pump, swamp cooler, or some other type of cooling unit, will be in-demand in the coming months. So why act preventively? There are two important reasons:

- As a seller, it pays to have your air conditioning unit running smoothly while the house is on the market. With our typical heat spells here in the Tri-Cities where temperatures reach over 100 degrees you will be thankful you were proactive. If something happens to your unit while your home is listed, a non-air-conditioned home will definitely turn off potential buyers. If something happens on a weekend or in the evening, the service call to get repairs done quickly might cost you hundreds of dollars. Preventative service may help avoid this. Remember, servicing the unit may be something the buyer asks for at the inspection anyway, so this may already be an expense you would incur.

- As a new homeowner, it is a fact that you are likely to live differently in your house than the previous owner. Say you keep the home at a cool, crisp 68 degrees but the previous owner enjoyed the home at 75 degrees. Appliances, trying to accommodate this kind of change, can have system issues. If you think you are in the clear having bought a brand new home, think again. Just because a system is new does not mean it is free from any manufactures or other defects. If you sense the system is not operating optimally or cooling effectively call your contractor right away. Any good home builder will have contracted with a reputable HVAC company that uses good quality equipment and will warrant the product for a set amount of time.

As always call Jennifer Cowgill at 509-947-5670 or myself, Jessica Johnson at 509-947-2230 for any real estate buying, selling or building needs in Richland, Pasco, Kennewick and the surrounding areas!

Now go enjoy the Summer we are known for here in sunny Tri-Cities Washington!

Do I need a “for sale” sign in my yard?

We recently had a request from a seller to not put a “For Sale” sign in their yard as the home was vacant and they didn’t want to attract “lookie-lous”.

The seller must indeed weigh the pros and cons of having a sign in the yard. Certainly, especially in the case of an empty home or in a situation where the sellers may be out of town, security may be a concern.

However, here are some facts to consider when making this decision according to the National Association of REALTORS® 2014 Profile of Home Buyers and Sellers:

- The first step taken by home buyers 6% of the time was to drive by homes and neighborhoods.

- 48% of buyers cited that yard signs were a source of information used in the home buying process

- 91% of buyers indicated a yard sign was “very useful” (32%) or “somewhat useful” (56%) source of information

- 9% of buyers ultimately found the home they purchased via a yard or open house sign

- 6% found the home they ultimately purchased through a friend, relative, or neighbor

Generally speaking we don’t see “lookie-lous” as all that bad. Even though they may not be in the market to buy now they can be a source of referrals; chances are they know someone who is.

When it comes to safety and security regarding signs at vacant homes, it can be as easy as setting up a shared schedule with the seller to check in on the home often to ensure things are secure. Staging an empty home and installing security and/or motion lighting can also be beneficial.

The bottom line is the more people who know a home is actively for sale, the better the chances are for it to sell quickly and signs are a sure way to increase exposure.

Contact Jessica at 509.947.2230 or Jennifer at 509.947.5670 for more useful information on selling your home.

Staging Your Home to Sell In Any Market

You have likely heard the term, “staging” when discussing making your home ready to sell. If you’re not familiar with the term, staging is the process of organizing a home and the décor therein in order to create a sale as quickly as possible, for as much money as possible. This is done by highlighting the positive features of a home, while camouflaging those which are less so. It is also the art of making your home appealing to the widest range of buyers possible.

Is staging necessary to sell real estate in the Tri-Cities? Absolutely! In fact, review this study supplied by the Real Estate Staging Association (RESA) in 2012:

- 89 homes were listed, unstaged. These homes did not sell and were on the market for an average of 166 days.

- These same homes were staged and received their first offer in an average of 32 days.

A separate RESA study reviewed 359 homes that were staged before they went on the market. On average, these homes received an offer 26 days after being on the market and 69 of those homes received multiple offers.

Staging works! If you are thinking about selling, consider the following first steps for staging your home:

- Stage the whole home, not just certain rooms. Kitchens and master bedrooms “sell” homes, but there are many more rooms in your home. Laundry rooms, pantries, cabinets, bonus rooms, and even your refrigerator will benefit from special staging treatment. I recommend removing everything from the space, wiping down the surfaces, throwing away what you no longer need, storing what you don’t need for the next three months, and then putting back what you do in a nice and neat manner at a minimum.

- Don’t ignore the closets and garage. If your idea of staging is clearing away clutter and putting it in a closet (or your garage), think again. Rent a storage facility and remove off-season clothing, recreation items, and anything else you aren’t going to use for the next 90 days, and then remove at least a third of what remains.

- Home staging also includes touching up paint and cosmetic defects. Painting corners, wipe down the baseboards, make sure all the light bulbs are in working order, make sure all the drawers and cabinets open correctly, etc.

- Home staging should not be thought of as a cover-up for deferred maintenance or structural problems. If there are issues you need to address, do that now. They’re just going to come up on the inspection anyway!

- Staging also applies to the outside of your house. Pressure washing, pruning shrubs, making sure the paint is touched up outside, and make sure the containers are full of flowers.

Like most things in life, the final steps of staging are often best left to qualified professionals who can look at your home with a strategic eye. If you are looking to sell this year, take the first steps outlined above, but give us a call for personal guidance. Call Jennifer at (509) 947-5670 or Jessica at (509) 947-2230.

Finding a Diamond in the Rough – A Guide for Home Buyers

The Tri-Cities real estate market is healthy with houses selling at a steady pace. The National Association of REALTORS® predicts that prices should rise about 6% next year nationally with interest rates rising to 5.8%. Those stats may have potential homebuyers who had planned on moving next year scratching their heads and wondering if the time is right to make a move now. But what if they can’t find exactly what they are looking for?

There are buyers in the market right now who are still looking for a “deal” despite the health of the market. And other buyers who are out looking but just aren’t finding that house that feels “just right.” Should they be looking at homes that have been on the market for six months, nine months, a year or more with the hopes of getting a deal and doing an extensive renovation? Or if scores of other buyers have bypassed these homes, should you stay away too?

Home improvement shows have made the idea of purchasing something unappealing and retrofitting to the buyer’s unique tastes seems appealing – even easy! As you determine if a home that has languished on the market is really a diamond in the rough awaiting polishing, consider why the home may still be on the market. Unless these problems are solved that caused the home to be on the market so long are fixed, you could run into the same problem when it is time to sell unless you make the required changes.

Homes that are on the market for a long time usually have a common list of challenges:

Overpriced property. This is the easiest obstacle to overcome in terms of fixing the problem – if the seller is willing. Even the ugliest property will sell if it is priced right. The key is to widen the buyer pool as much as possible by lowering the price to what the pool of buyers – or at least one of them – will pay. Sellers may steadfastly hold to their price, but the bottom line is if the home has been on the market for months, generally the price needs to be reduced to meet the market.

As a potential buyer, before purchasing a property, it is important for the buyer’s agent to do a comparative market analysis (CMA) so the buyer will have an estimate of market value before purchasing to make sure they are making a sound investment.

Floorplan/Flow is awkward. Is the master bedroom two floors away from the other bedrooms? Is there only one bathroom for the whole house? Is the kitchen small in proportion to the rest of the house? Are the rooms small with little closet space? Floorplan/flow challenges such as these may be easy to overcome with a remodel. It is important to do your due diligence first and determine a remodel is possible – and within your budget. Also, features such as multiple flights of stairs will keep certain buyer pools from considering the property (such as seniors or perhaps parents of young children) and may not be easily remedied by a remodel. Furthermore, there may be zoning restrictions if altering the outside of the home is required and should be investigated before finalizing the purchase.

Location location location. Are there power lines nearby? Is the home located beneath the flight path to the airport? Is the home located on or nearby a very busy street? These types of challenges are not ones that can be altered. Therefore, if the home is located near something that others might find disturbing or a nuisance, this should be reflected in the price of the property to attract the largest buyer pool – both now and down the road when it comes time to sell.

Dated, but easily updated. If the home is in a good location and everything else looks favorable, but the rust-colored linoleum and pink sink and tub in the bathroom is giving you pause, then this may indeed be the diamond in the rough you have been looking for! If the rest of the “bones” of the house are desirable such as general house layout, roof, supports, etc and the updates are mostly cosmetic or involve moving just a few non-supporting walls, then you may have found your home.

If you are not afraid to expend a little elbow grease and have a renovation budget to get the home of your dreams, you may be richly rewarded! If you have been eyeing a listing that has been on the market awhile or would like to learn about potential diamonds in the rough in our area, give us a call! Jennifer Cowgill can be reached at (509) 947-5670 or Jessica Johnson at (509) 947-2230.

Real Estate Investing: The Power of Leverage

One question we get a lot is “how do I begin investing in real estate? Whether someone is considering a second home, a property to improve and sell, or a property to rent and hold, investors starting out need to understand the power of leverage.

Leverage is the term used when one may not have the cash on hand to buy something outright, so they borrow someone else’s money (usually a bank’s) to finance their investment. Certainly the loan is paid back with interest, but the asset purchased appreciates at the full amount of the investment regardless of what was borrowed.

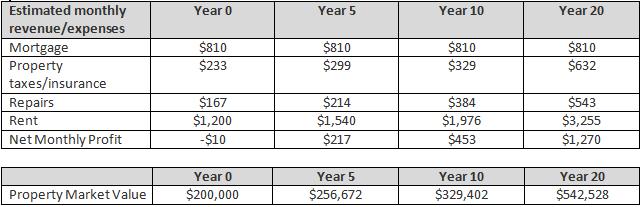

Let us give you an example. Let’s say a new real estate investor wants to purchase a second home in our area at $200,000. He has 20% to put down, or $40,000. He borrows $160,000 from the bank at 4.5% interest for a 30 year fixed rate loan and he plans to rent out the home for $1,200 per month.

His principle and interest payment is $810 per month. Of course, this does not include property taxes or insurance, which can be estimated at another $233 per month. Additionally, it is smart to estimate repairs at least 1% of the home value – in this case $2,000 per year.

At first glance, it doesn’t appear that the math works in this property owner’s favor as he is looking at a net loss in this case of $10 per month! And that is assuming that the property does not remain vacant, need major repairs, and he handles the rental himself instead of involving a property management company.

Here is where the value of appreciation and cost of living come into play. Unless our investor refinances, his payments for the next 30 years will be $810 per month. However, during that time a number of other forces are at work. Rents rise each year. At an approximate 5% increase per year in rent, that $1,200 in income today will equate to $1,540 in five years. We can assume that property taxes and insurance might rise at that same rate, leaving our investor in a slightly better position monthly than his $9 net loss of five years previous.

Let’s take a closer look at the 10 year figures listed above. At a modest 5% appreciation, the property purchased today would be worth $329,402 in 10 years. If our investor decided to sell and walk away from the $453 in net profits per month, he could be looking at gross proceeds of $201,259 (as his loan at this point has been reduced to $128,143). This doesn’t take into account closing costs, but isn’t it amazing how $40,000 can turn into over $200,000 in a relatively short amount of time?

Additionally, savvy investors need to realize there is another perk of owning multiple properties -interest deduction on taxes. The mortgage interest paid on your home loans is tax deductible depending on how your investments are set up. In the example above, $7,147 is paid in interest on the first year alone which could result in big tax savings!

If you are interested in learning more about how to leverage your next home purchase or real estate investments, please contact us: Jennifer at (509) 947-5670 or Jessica at (509) 947-2230.

Rising Interest Rates and Homeowners – What You Need To Know

According to Bankrate.com, 30 year mortgage interest rates were at 4.74% week before last from 4.57% the week before) and are up 1.5% since the lows hit in December of 2012. This is also higher than one year ago when mortgage rates were 3.91%.

According to Bankrate.com, 30 year mortgage interest rates were at 4.74% week before last from 4.57% the week before) and are up 1.5% since the lows hit in December of 2012. This is also higher than one year ago when mortgage rates were 3.91%.

While this may not seem like a significant increase, it can have an impact on buying power. For example, on a $200,000 loan, the change in interest rates from 3.91% to today’s 4.74% is $98 more per month or $35,280 over the life of the loan.

Interest rates are expected to continue to rise which has caused some buyers who were previously on the fence to get into the buyer pool now to the delight of sellers. If you have been considering selling your current home and moving to something larger, in a better location, or something with higher-quality finishes, this would classify you as a “move-up buyer” and rising interest rates may affect you more than other types of seller/buyers. Here’s why:

First-time homebuyers don’t have a home to sell. Their buying power certainly ties into interest rates, but the financial impact is less when the loan amount is lower. For example, on that $200,000 loan example above, the difference was $98 more per month. However, on a loan of $140,000, that difference is lessened to $68 per month.

Downsizing buyers may be saving per month after downsizing as they may be using the equity in the more-expensive home they are selling to put a larger down payment on the home they are downsizing to. For example, let’s say a retired couple is selling their home they have lived in for 15 years. They will be selling it for $300,000 and have $100,000 in equity in it. They plan on buying a home for $209,000 and they are putting their $100,000 as a down payment, leaving them with a loan amount of only $109,000. The difference between 3.91% and 4.74% for this loan amount is $53 per month.

However, the downsizing buyer still needs to sell their home. As interest rates rise, the number of buyers who can buy their home at that price will shrink. Therefore, downsizing buyers do still need to watch rates.

The move-up buyer needs to keep a close eye on interest rates as they are considering their move. For example, let’s say the move-up buyer has a home they are going to sell for $200,000 and they want to buy a home that is listed for $300,000. In this case they have about $50,000 in equity in the first home. This means they will take out a loan of about $250,000 for their move-up property.

If interest rates go up as in the 3.91% to 4.74% example, this can affect the move-up buyer two-fold. First, the buyer pool for their home they are trying to sell will shrink, making it more difficult for them to sell (although it can be argued that the same thing will happen with the home they wish to purchase) Second, the amount they would need to pay each month for their mortgage will increase (by $122 per month!)

The bottom line? If you are thinking about buying or selling, interest rates will definitely have an impact on the home you can purchase and how many buyers are available to purchase your home if you are trying to sell. Move-up buyers should consider the number of buyers who are in the market right now, wanting to buy, as this could be a great time to sell and find a great deal at a good interest rate. But time is of the essence. Please call us to learn your options and what moving now versus moving later could look like. Please call Jessica at (509) 947-2230 or Jennifer at (509) 947-5670.

All mortgage examples are for a 30 year fixed rate mortgage and payment amounts include principal and interest only. Downpayments, homeowners insurance, property taxes, private mortgage insurance, closing costs, etc have not been factored into these examples.

HOMEOWNERS: The New Carbon Monoxide Detector Law pertains to you!

The State of Washington recently revised RCW 19.27.530 which requires that all single family residences, condominiums, apartments, hotels and motels have working carbon monoxide detectors installed. Single family homes that were occupied before July 26, 2009 are exempt until the home is sold, at which point the seller must install a detector. This new revision requires strict regulation of carbon monoxide detectors in homes, condominiums, apartments, hotels and motels and allows for enforcement to make sure these regulations are being followed.

Carbon monoxide detectors are similar to smoke detectors in their operation. They are designed to save lives by sensing dangerous carbon monoxide levels and sounding an alarm to evacuate when these become too high and unsafe.

Under the past law, new residences must have carbon monoxide alarms installed upon completion. However, this new law applies to any home that is sold.

Why is there such a concern over carbon monoxide? Carbon monoxide is a very dangerous poisonous gas which cannot be seen or smelled. It is so dangerous it can kill a person or an animal in a very short period of time. Carbon monoxide can quickly build up to fatal levels in either enclosed areas, semi-enclosed areas or non-ventilated areas.

It naturally occurs when fuel is burned. Cars, trucks, small gasoline power equipment like trimmers, chain saws, boat engines, lanterns, burning charcoal and wood, gas ranges, ovens, and furnaces produce carbon monoxide. It is also produced from tobacco smoke.

If you are thinking about selling your property this spring, you need to learn your options now and be prepared to have a detector installed.

And buyers listen up! If you are purchasing a bank-owned property, the property is not exempted from this law. Make sure that the home you are purchasing comes with a carbon monoxide detector.

We are advising our clients to make sure they have their carbon monoxide detector installed by a professional. This is essential for both safety and liability reasons.

If you have any questions about this new law as it might pertain to your personal situation please feel free to give us a call. You can reach Jennifer at (509) 947-5670 or Jessica at (509) 947-2230. We would happy to discuss your options with you.

SOURCE:

http://apps.leg.wa.gov/rcw/default.aspx?cite=19.27.530