We have been getting a lot of inquiries lately about interest rates. As you may or may not know, interest rates have been quietly creeping up since December of 2012. At that time, the rates for a 30 year fixed rate mortgage were at a record of 3.35%. The last few weeks, however, rates have been hovering around 4% or more for the first time since November of 2011. Just how much of a difference can this .65% increase make? You might be surprised!

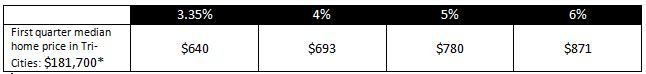

Below is a table which illustrates the corresponding monthly payment for a home purchased at our first quarter, 2013 median home price of $181,700. This assumes a 20% down payment with principle and interest only on a 30 year fixed rate mortgage.

If you are in the market for a home and you see that mortgage interest rates have gone up a small fraction of a percent, is that cause to panic and change direction? Of course not, but if you are in the market for a home, it does make sense to establish a close relationship with a lender right away who can quickly spot interest rate trends and get you “locked in” if conditions are favorable and you are within days or hours of submitting your loan application.

Do you see how just by waiting six months can diminish a buyer’s buying power? The difference between 3.35% and 4% is $53 a month or over $19,000 over the life of the loan!

Currently, the rates are being kept artificially low due to the government buying bonds in an effort to stimulate the economy. However, with the economy growing stronger, the Federal Reserve is expected to cut back on buying bonds, causing rates to rise. Chief Economist for the National Association of REALTORS®, Lawrence Yun, predicts interest rates could go as high as 5% by the end of the year. At our median home price of $181,700, that could equate to a monthly payment of $87 more per month than where rates are right now – or $31,320 over the life of the loan.

If you think you may be on the move in the coming weeks or months, give us a call. We can provide you scenarios based on interest rates now and what your situation may look like with different interest rates in place so you can make informed decisions. Please give us a call – Jessica (509) 947-2230 or Jennifer (509) 947-5670.