One question we get a lot is “how do I begin investing in real estate? Whether someone is considering a second home, a property to improve and sell, or a property to rent and hold, investors starting out need to understand the power of leverage.

Leverage is the term used when one may not have the cash on hand to buy something outright, so they borrow someone else’s money (usually a bank’s) to finance their investment. Certainly the loan is paid back with interest, but the asset purchased appreciates at the full amount of the investment regardless of what was borrowed.

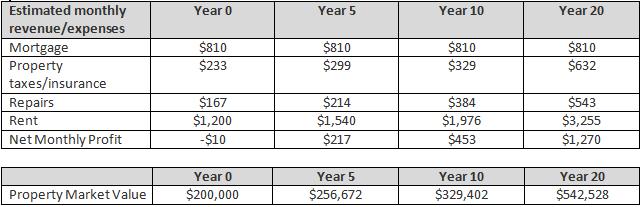

Let us give you an example. Let’s say a new real estate investor wants to purchase a second home in our area at $200,000. He has 20% to put down, or $40,000. He borrows $160,000 from the bank at 4.5% interest for a 30 year fixed rate loan and he plans to rent out the home for $1,200 per month.

His principle and interest payment is $810 per month. Of course, this does not include property taxes or insurance, which can be estimated at another $233 per month. Additionally, it is smart to estimate repairs at least 1% of the home value – in this case $2,000 per year.

At first glance, it doesn’t appear that the math works in this property owner’s favor as he is looking at a net loss in this case of $10 per month! And that is assuming that the property does not remain vacant, need major repairs, and he handles the rental himself instead of involving a property management company.

Here is where the value of appreciation and cost of living come into play. Unless our investor refinances, his payments for the next 30 years will be $810 per month. However, during that time a number of other forces are at work. Rents rise each year. At an approximate 5% increase per year in rent, that $1,200 in income today will equate to $1,540 in five years. We can assume that property taxes and insurance might rise at that same rate, leaving our investor in a slightly better position monthly than his $9 net loss of five years previous.

Let’s take a closer look at the 10 year figures listed above. At a modest 5% appreciation, the property purchased today would be worth $329,402 in 10 years. If our investor decided to sell and walk away from the $453 in net profits per month, he could be looking at gross proceeds of $201,259 (as his loan at this point has been reduced to $128,143). This doesn’t take into account closing costs, but isn’t it amazing how $40,000 can turn into over $200,000 in a relatively short amount of time?

Additionally, savvy investors need to realize there is another perk of owning multiple properties -interest deduction on taxes. The mortgage interest paid on your home loans is tax deductible depending on how your investments are set up. In the example above, $7,147 is paid in interest on the first year alone which could result in big tax savings!

If you are interested in learning more about how to leverage your next home purchase or real estate investments, please contact us: Jennifer at (509) 947-5670 or Jessica at (509) 947-2230.